David Pollard who studied Applied Maths at Cambridge and took a PhD in Theoretical Physics at Imperial College, is the Fund Advisor. He has managed portfolios of Caribbean stocks since 2006. Our CTO, Peter Lappo is a PhD computer scientist with experience at JP Morgan, AHL and RBS and a Masters in Quantitative Finance.

The Fund aims to generate returns for clients that substantially exceed inflation. It does this by investing in early, emerging markets that are regulated and deliver high growth. These markets typically have low liquidity and therefore require medium term investment horizons. The Fund also seeks to improve its returns by financial innovation in appropriate markets. All monies are invested in one Fund so that clients’ and shareholders’ investments are not differentiated and therefore subject to the same risks. Fees charged to client funds are clearly specified in the contract and transparently calculated every quarter. Clients get monthly valuations of their holdings and receive the Fund’s quarterly newsletter explaining investment performance. The companies’ accounts in both the UK and the Caribbean are examined and audited annually by external accountants.

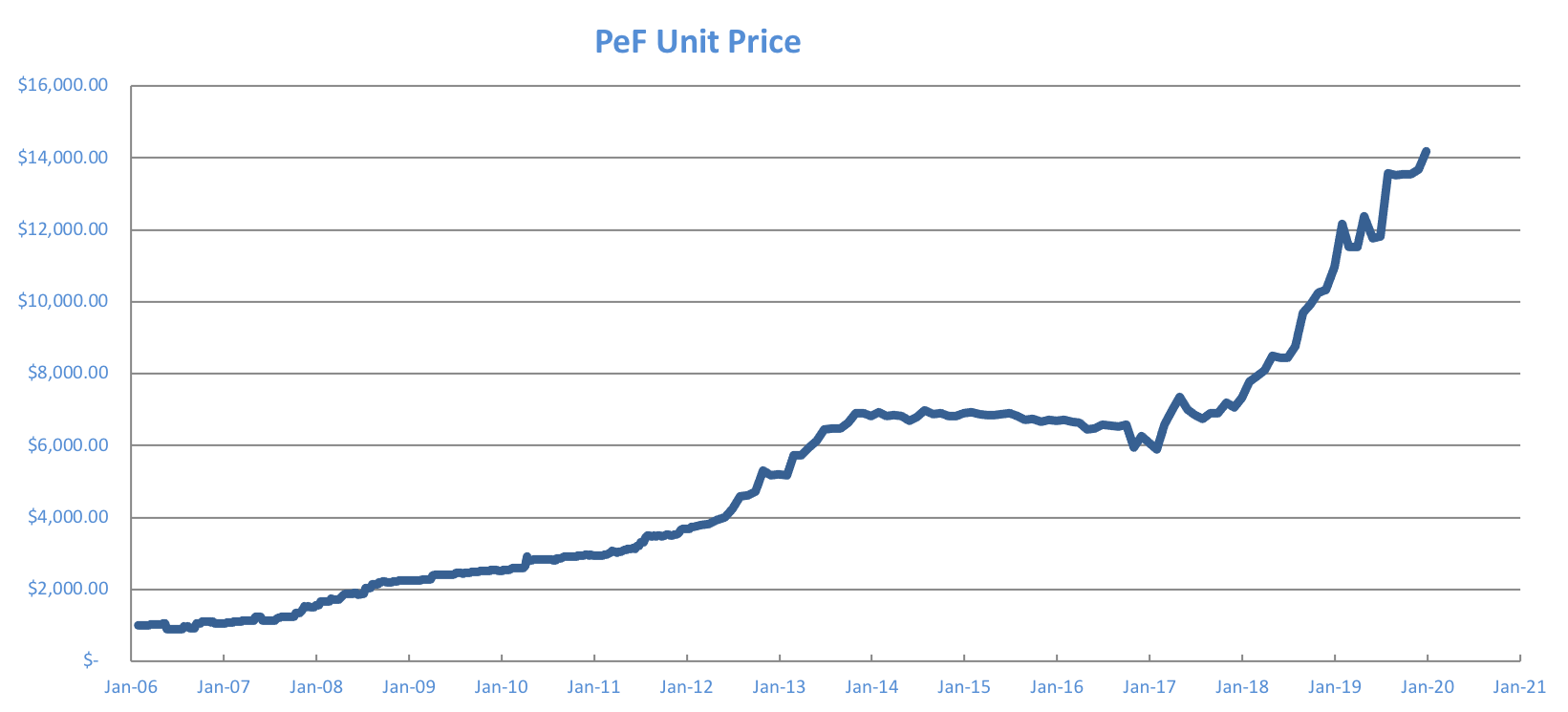

The Pollard Et Filles investment approach has achieved a gross compound annual growth rate of 23% since trading began in 2006. This performance is quite de-coupled from the normal activity that we see in traditional, Western equity markets. For instance, during the crisis in 2007-2008, the Fund generated gross returns of 54% and 36% respectively.

Caribbean and South American equity and bond markets can provide returns that compensate for inflation and financial risk in the region. Pollards Et Filles has the people, trading experience, safeguards and track record to deliver good returns for financially sophisticated investors with a global perspective.

Source: Pollards Et Filles Accounts. Please contact us on info@pollardsetfilles.com for further information on performance